BlackRock’s Ethereum ETF $ETHA Listed on DTCC After SEC Approval

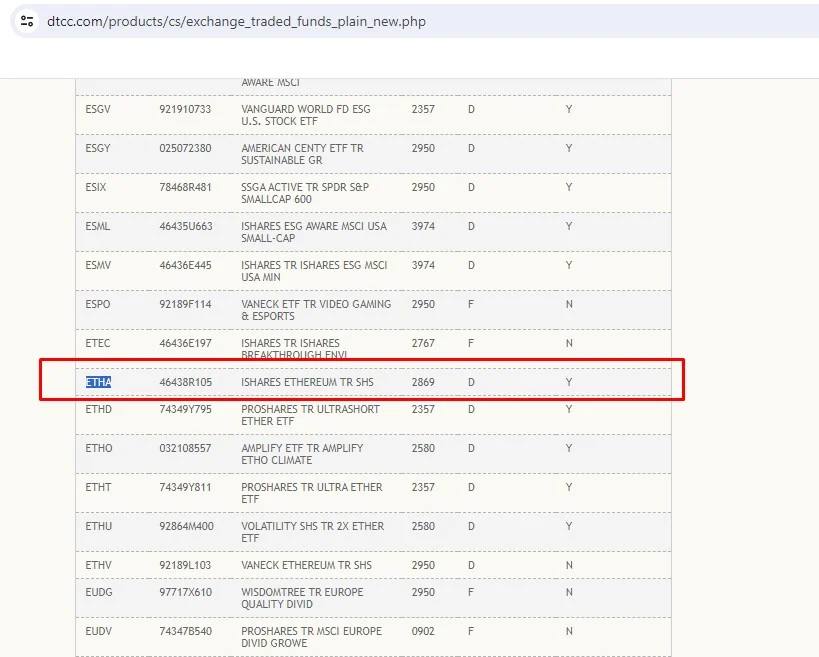

BlackRock’s spot Ethereum exchange-traded fund (ETF) has been listed on the Depository Trust and Clearing Corporation (DTCC) under the ticker symbol $ETHA. This listing comes on the heels of the US Securities and Exchange Commission’s (SEC) approval of eight spot Ethereum ETFs, marking a pivotal moment for the digital asset investment landscape.

Table of Contents

BlackRock’s Ethereum ETF on DTCC

The SEC’s approval includes ETFs from major asset managers such as VanEck, Fidelity, Franklin Templeton, Grayscale, Bitwise, ARK Invest & 21Shares, Invesco & Galaxy, and BlackRock’s iShares Ethereum Trust. These ETFs are slated for listing on major exchanges like Nasdaq, NYSE Arca, and the Cboe BZX Exchange

However, despite the approval of the 19b-4 forms by the SEC, actual trading of these ETFs is pending until the SEC approves each ETF’s S-1 filing. The timeline for this approval process varies, with estimates ranging from a few weeks to several months.

Approval Process and Timeline

Bloomberg ETF analyst James Seyffart emphasized that the approval of 19b-4 forms does not immediately initiate trading. Each ETF requires approval of the S-1 documents, a process that could extend for up to five months. Seyffart noted that while efforts could accelerate the process, historical examples suggest it may take several weeks to finalize.

An SEC spokesperson declined to comment on the recent approval, underscoring the regulatory caution surrounding these novel financial products.

The Road to Approval

The approval of Ethereum ETFs by the SEC came as a surprise to many, given the perceived hesitation from the commission in recent months. A sudden shift in engagement between the SEC and issuers sparked speculation over the catalyst behind this change in stance.

A bipartisan group of lawmakers had urged the SEC to approve the ETFs earlier this year, citing consistency in applying regulatory standards and legal reasoning similar to the approval of spot Bitcoin exchange-traded products.

Implications and Market Response

Ahead of the ETF approvals, market dynamics were already shifting. The Grayscale Ethereum Trust, for instance, saw its discount shrink from -24% to -6%, anticipating its conversion into an ETF. This conversion would allow shareholders to exchange their shares for the cash equivalent of the underlying ether, potentially increasing liquidity and market accessibility.

Comparatively, while Bitcoin ETFs garnered significant traction post-approval, accumulating an additional 207,000 bitcoin ($14 billion) on top of the existing holdings in the Grayscale Bitcoin Trust, Ethereum ETFs may face different challenges. Bloomberg’s Eric Balchunas estimated that Ethereum ETFs might capture 10 to 15% of the assets seen by their Bitcoin counterparts, translating to an estimated $5 to $8 billion.

Conclusion

n conclusion, the listing of BlackRock’s Ethereum ETF on the DTCC marks a critical milestone in the acceptance of cryptocurrencies within traditional financial markets. As the market eagerly awaits further developments, the approval of these ETFs by the SEC signals a broader acceptance of Ethereum as an investable asset. Investors and stakeholders alike are now poised to navigate this evolving landscape, anticipating the potential impact of Ethereum ETFs on the broader digital asset market.