VanEck’s Spot Ether ETF Listed on DTCC, Awaits SEC Approval for Market Debut

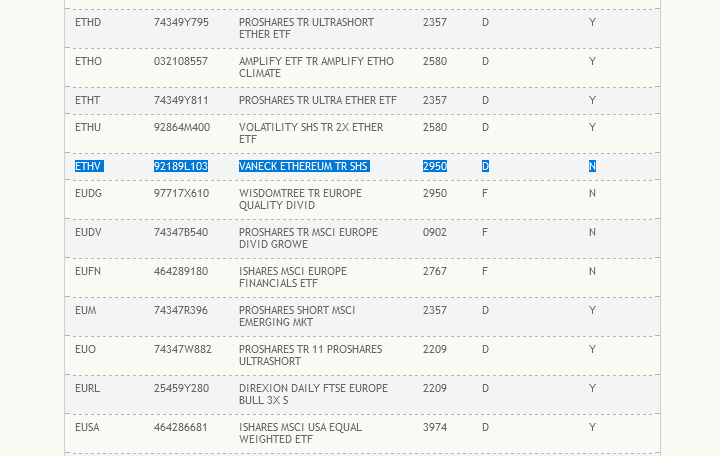

Amid increasing speculation about the possible approval of a spot Ether exchange-traded fund (ETF) in the United States on May 23, VanEck’s ETF has been listed by the Depository Trust and Clearing Corporation (DTCC) under the ticker symbol “ETHV.” This article explores the significance of this development, its impact on the broader cryptocurrency market, and the potential future of Ethereum investment.

Table of Contents

The Role of DTCC in Financial Markets

The DTCC is an American financial market infrastructure provider offering clearing, settlement, and transaction reporting services to financial market players. A listing on the DTCC is considered a crucial step before final approval from the U.S. Securities and Exchange Commission (SEC). This listing indicates that the ETF is in the final stages of preparation, awaiting regulatory approval to become active.

VanEck’s ETF: Current Status and Historical Context

VanEck’s ETF is currently designated inactive on the DTCC website, meaning it cannot be processed until it receives the necessary regulatory approvals. However, VanEck is not the first Ether ETF listed by the DTCC. Franklin Templeton’s spot ETH ETF was listed on the platform a month ago, highlighting the growing interest in Ethereum-based financial products.

The Significance of DTCC Listing

The DTCC listing includes both active ETFs that may be processed and ETFs that are not yet active. This distinction is crucial for understanding the current status of VanEck’s ETF and its potential for future trading.

SEC’s Role and Market Speculation

Another report suggested that SEC officials contacted Nasdaq, the Chicago Board Options Exchange, and the New York Stock Exchange to update and change existing spot Ether ETF applications. The significant change in the SEC’s stance over the past week is speculated to be linked to the White House.

Crypto lawyer Jake Chervinsky noted in a post on X that politics drive policy, and for months, crypto has been winning the political battle. He also speculated that former president Donald Trump’s endorsement of cryptocurrency compelled the administration of President Joe Biden to shift its policy.

The Critical Deadline and Regulatory Developments

May 23 is the final deadline for the SEC’s decision on the VanEck spot Ether ETF application. After months of speculation about a probable denial of spot ETH ETFs, the SEC took action earlier this week. The SEC first asked financial managers to amend and refile their 19b-4 filings on their proposed spot Ether ETFs. Some analysts saw the move as a positive sign, swinging the potential chance of approval to 75% from 25%.

Direct Access to Ethereum for Investors

The DTCC’s inclusion of the VanEck Spot Ethereum ETF signals a noteworthy endorsement of Ethereum as a legitimate and investable asset. This listing leverages the DTCC’s infrastructure, enhancing trading security, transparency, and efficiency.

Appeal to Institutional and Retail Investors

For institutional investors, the VanEck Spot Ethereum ETF offers a regulated and secure way to gain exposure to Ethereum. Institutions, which may face restrictions or have reservations about directly purchasing and holding cryptocurrencies, can now add Ethereum to their portfolios via a familiar and regulated investment vehicle.

On the other hand, retail investors benefit from the ease of trading an ETF on a traditional exchange, bypassing the need for digital wallets or dealing with the technical intricacies of cryptocurrency exchanges.

VanEck’s Commitment to Regulatory Standards

The listing of $ETHV on the DTCC follows a rigorous approval process. It reflects VanEck’s commitment to adhering to regulatory standards and providing a trustworthy investment product. This ETF is designed to appeal to a broad range of investors, including institutional players and individual retail investors seeking to participate in the rapidly evolving cryptocurrency market.

The Broader Trend of Traditional Financial Institutions Embracing Digital Assets

VanEck’s move to launch an Ethereum ETF is a significant development in the cryptocurrency market. ETFs, or Exchange Traded Funds, are marketable securities that track an index, sector, commodity, or other asset. In this case, the VanEck Ethereum Tr Shs will track the performance of Ethereum, one of the leading cryptocurrencies. This development is part of a broader trend of traditional financial institutions embracing digital assets. As cryptocurrencies like Ethereum continue to gain mainstream acceptance, more financial products tied to these assets are likely to emerge.

SEC’s Request for Updated Filings

Earlier this week, the SEC reportedly asked U.S. firms to update and refile their 19b-4 filings on their proposed spot Ether ETFs, which was seen as a positive sign that could indicate a potential approval from the regulator. The 19b-4 forms are filed to notify the SEC about a proposed rule change and are among the documents that need the agency’s greenlight before spot Ether ETFs can become effective.

The Pivotal Role of Regulatory Approval

On Tuesday, Cboe BZX exchange posted the amended 19b-4 forms for the spot Ether ETFs from Franklin Templeton, Fidelity, VanEck, Invesco Galaxy, as well as Ark Invest and 21Shares. According to Fox News reporter Eleanor Terrett, coinShares and Valkyrie do not plan to apply for a spot Ether ETF.

Potential Impact on Ethereum and the Crypto Market

The approval of a spot Ether ETF would mark a significant milestone for Ethereum and the broader cryptocurrency market. It offers investors a new way to access Ethereum directly, potentially driving increased adoption and investment in the cryptocurrency. This development could also pave the way for future ETFs focused on other digital assets, further integrating cryptocurrencies into traditional financial markets.

Conclusion

The listing of VanEck’s spot Ether ETF on the DTCC website marks a significant step towards the potential approval and launch of this financial product. As the SEC’s decision deadline approaches, the cryptocurrency market remains on edge, with the outcome likely to have far-reaching implications for Ethereum and the broader crypto ecosystem. If approved, the VanEck spot Ether ETF could provide a regulated and accessible way for investors to gain exposure to Ethereum, marking a pivotal moment in the ongoing integration of digital assets into the traditional financial landscape.