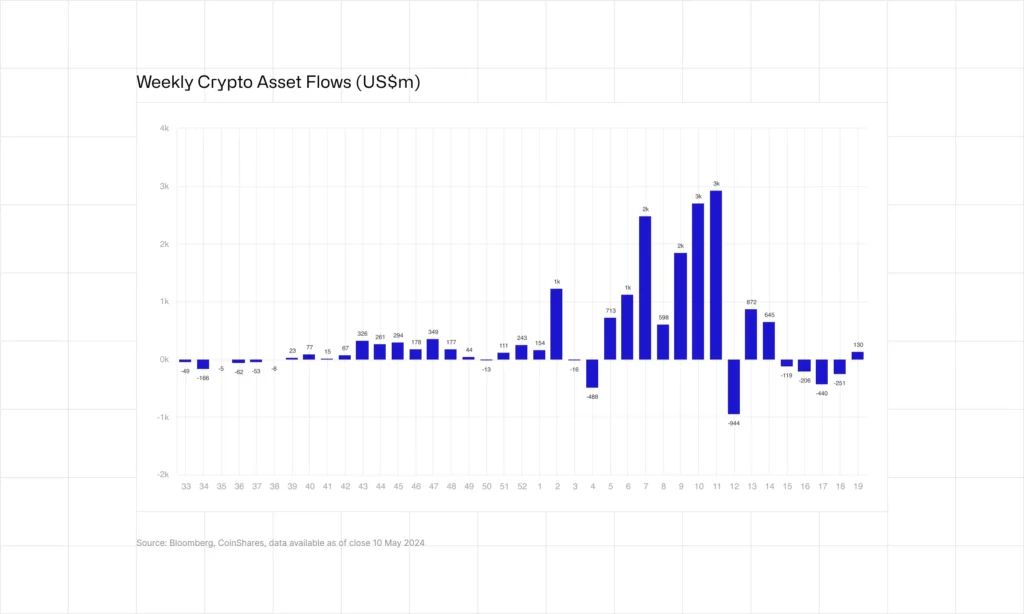

Crypto ETPs See Significant $130M Inflows After Four Weeks of Outflows

After a month-long trend of capital outflows, investors have begun reinvesting in cryptocurrency exchange-traded products (Crypto ETPs). According to the CoinShares Digital Asset Fund Flows Report dated May 13, institutional digital asset investment products received an influx of $130 million last week. This reversal marks the end of a five-week streak of outflows, signaling renewed investor confidence in the crypto market.

Table of Contents

Renewed Investor Confidence

Grayscale Bitcoin Trust Sees Reduced Outflows

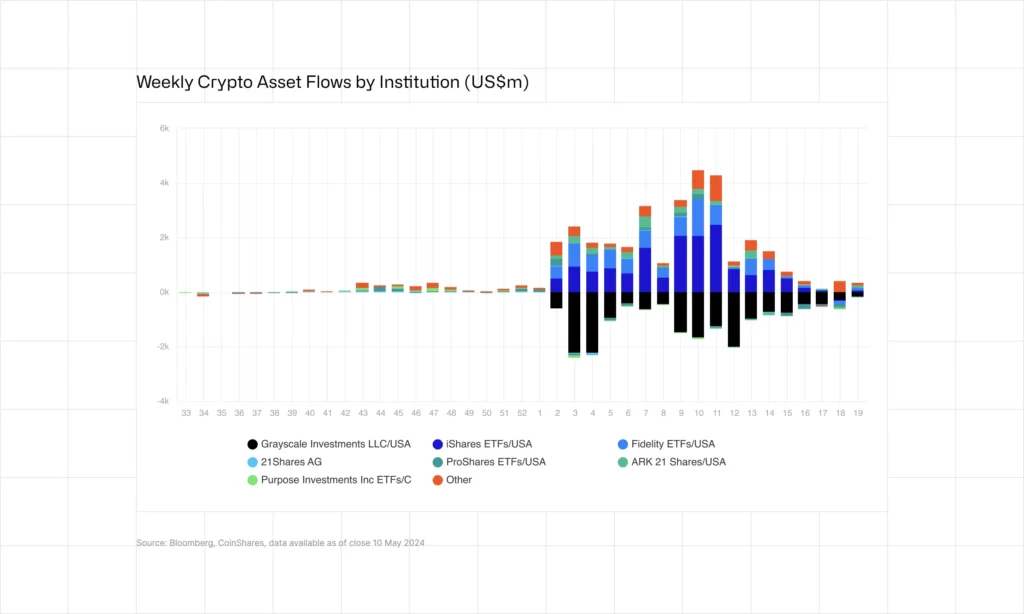

The shift in sentiment coincides with the Grayscale Bitcoin Trust (GBTC) recording its smallest outflow since converting into an exchange-traded fund (ETF) in January. On May 13, GBTC reported zero inflows or outflows, a significant change from the substantial withdrawals seen earlier this year. To date, nearly $17.6 billion has exited the fund since its conversion, but the recent stabilization suggests a potential turnaround.

Leading Inflows in Bitcoin ETFs

Fidelity’s Bitcoin ETF saw the most substantial inflows among the various ETPs, attracting $111 million. Ark 21Shares followed with $83 million, and BlackRock garnered $48 million. Despite this positive movement, Bitcoin (BTC) experienced a 4% pullback from its local high of $64,120 on May 7, extending a prolonged period of range-bound trading between $60,000 and $70,000 since March.

Regional Insights: U.S. Dominates Inflows

U.S. Leads the Charge

U.S.-based ETP providers were at the forefront, with $135 million in inflows. This figure is significantly higher compared to other regions, demonstrating strong institutional interest in American crypto markets.

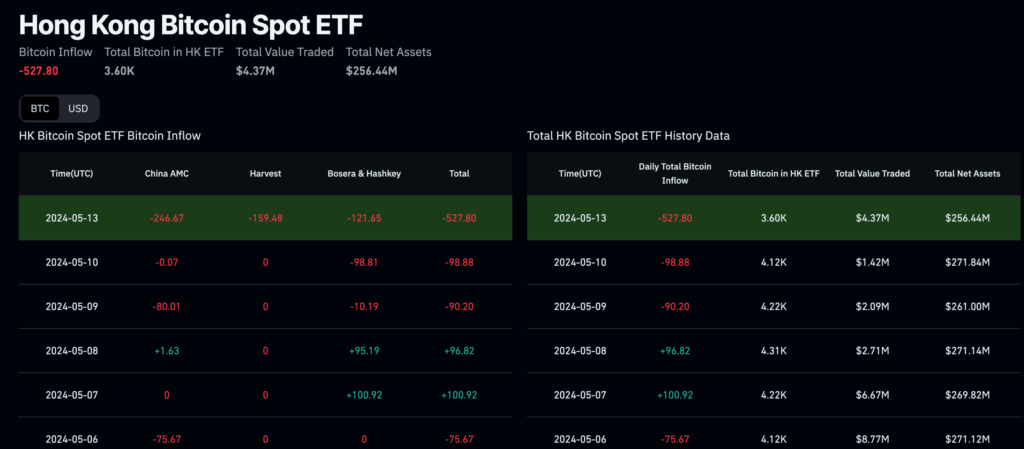

Hong Kong and Switzerland Show Activity

Hong Kong recorded $19 million in inflows, a sharp decline from the previous week’s record of $307 million. According to CoinShares, the dramatic drop suggests that much of the initial inflows were seed capital following the launch of Bitcoin ETFs. Switzerland also saw $14 million in inflows, further highlighting the varied but cautious interest across different regions.

Contrast in Europe and Asia

European markets such as Germany and Switzerland showed contrasting trends. While Switzerland enjoyed inflows, Germany faced outflows totaling $15 million. In Asia, Hong Kong’s earlier robust inflows significantly dwindled, reflecting fluctuating investor sentiment.

Ethereum ETPs Face Outflows Amid Regulatory Uncertainty

Anticipation of SEC Decision

While Bitcoin ETPs enjoyed positive inflows, Ethereum (ETH) ETPs did not fare as well, suffering $14.4 million in outflows. Analysts attribute this to speculation that the U.S. Securities and Exchange Commission (SEC) might reject pending applications for spot Ethereum ETFs. The SEC is set to decide by May 23, which has generated uncertainty and cautious behavior among investors.

Impact on Other Altcoins

Other altcoin ETPs, however, saw modest inflows. Solana (SOL) attracted $5.9 million, while Polkadot (DOT) and XRP each brought in $1.2 million. These figures suggest a selective but ongoing interest in alternative cryptocurrencies.

Trade Volume Trends: A Cautious Market

Decline in ETP Trading Volumes

Weekly ETP trade volumes were notably low, with only $8 billion worth of shares traded, down from the April average of $17 billion. This decline indicates that many investors are waiting for clearer market signals before making significant moves. The reduced trading activity highlights a period of caution and strategic positioning within the crypto ecosystem.

ETP Investor Participation

The report underscores that ETP investors are currently less active, reflecting broader market uncertainty. This decreased participation suggests that while there is optimism, it is tempered by the prevailing volatility and regulatory ambiguity.

Institutional Investment Patterns

Bitcoin’s Recovery

Bitcoin ETPs saw inflows of $144 million, recovering from a sluggish performance earlier in the month. This recovery aligns with the overall trend of renewed institutional interest, even as Bitcoin prices fluctuate within a tight range.

Short-Bitcoin ETP Outflows

Conversely, short-Bitcoin ETPs experienced outflows totaling $5.1 million, bringing the eight-week outflow total to $18 million. This trend indicates a waning interest in shorting Bitcoin, as investors might be anticipating a potential upward price movement.

Conclusion

The recent influx of $130 million into cryptocurrency exchange-traded products after four weeks of outflows signifies a tentative return of investor confidence in the crypto market. This shift, driven by renewed interest in Bitcoin ETPs and cautious optimism regarding other altcoins, reflects a complex landscape influenced by regulatory developments and market conditions. As investors navigate this environment, the forthcoming SEC decisions and ongoing market dynamics will likely play critical roles in shaping future investment trends. The cautious but optimistic sentiment among institutional investors suggests a period of strategic realignment as the crypto market continues to evolve.