Bitcoin Bulls Eye Return to Price Discovery as Bitcoin Price Inches Closer to All-Time Highs

Bitcoin price action is garnering renewed attention as it embarks on the final week of March, hovering tantalizingly close to previous all-time highs. After a period of consolidation marked by a brief retracement from recent peaks, Bitcoin enthusiasts are optimistic about the potential for a bullish resurgence.

Renewed Optimism Amidst Recent Volatility

The past week witnessed a notable shift in sentiment from the gloomy atmosphere of preceding weeks. Despite experiencing a moderate retracement from its highs near $74,000, Bitcoin managed to maintain resilience, mitigating losses and demonstrating a gradual upward trend. This positive momentum has injected a renewed sense of optimism among market participants.

Technical Indicators Signal Potential Upside

Analysts are closely monitoring key technical indicators for insights into Bitcoin’s short-term price trajectory. Mark Cullen, a prominent analyst, highlights the significance of filling the CME futures market gap, a common price phenomenon observed over weekends. This potential target is indicative of the market’s propensity to “fill” gaps within a short timeframe, suggesting an upward bias in the near term.

Mixed Signals Amidst Bullish Sentiment

While bullish sentiment prevails, some analysts caution against overexuberance, citing overbought signals on certain oscillators like the Relative Strength Index (RSI). However, others interpret daily RSI data as indicative of an impending bullish momentum, providing a nuanced perspective on Bitcoin’s short-term price outlook.

ETF Flows Reflect Market Dynamics

The performance of United States spot Bitcoin exchange-traded funds (ETFs) has garnered significant attention amidst recent market fluctuations. Despite experiencing net outflows, market observers anticipate a resurgence in ETF inflows, signaling sustained institutional interest in Bitcoin.

Macroeconomic Factors Add to Market Dynamics

The upcoming release of the Personal Consumption Expenditures (PCE) Index in the United States is poised to influence market sentiment, particularly in light of the Federal Reserve’s recent decision regarding interest rates. Analysts anticipate further insights into inflationary pressures and potential monetary policy adjustments, which could impact Bitcoin’s trajectory.

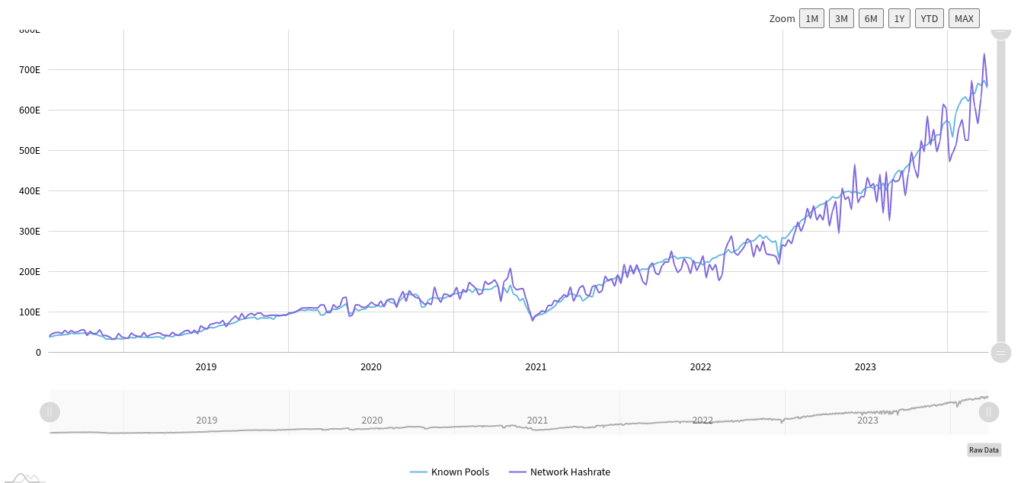

Mining Difficulty Maintains Record Highs

Despite recent price volatility, Bitcoin’s network fundamentals remain robust, with mining difficulty poised to sustain record highs. This resilience underscores the long-term viability of Bitcoin as a decentralized digital asset, despite short-term market fluctuations.

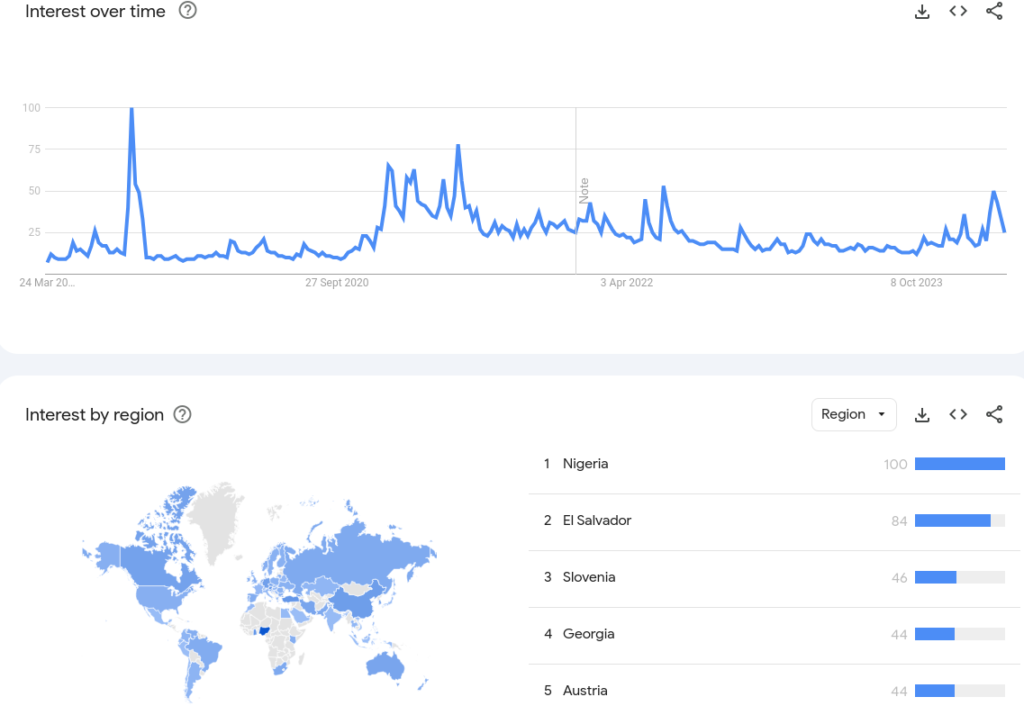

Mainstream Interest Wanes Amid Greed

While Bitcoin’s market sentiment remains “greedy,” mainstream interest appears to be waning, as reflected in declining search volumes on Google Trends. Nevertheless, analysts emphasize the enduring strength of Bitcoin’s bull market, citing institutional inflows as a key indicator of underlying market dynamics.

Conclusion: Navigating Uncertainty in Bitcoin’s Journey

As Bitcoin approaches critical price levels and navigates through market volatility, stakeholders remain cautiously optimistic about its long-term prospects. While short-term indicators may fluctuate, the underlying fundamentals of Bitcoin as a disruptive financial asset remain resilient, paving the way for continued growth and adoption in the digital economy.