BlackRock’s Bitcoin ETF Poised to Overtake Grayscale’s GBTC Bitcoin Holdings

The race for dominance in Bitcoin holdings among institutional giants is heating up, with BlackRock’s spot Bitcoin ETF set to potentially surpass Grayscale’s Bitcoin Trust (GBTC) holdings shortly. As of March 22, BlackRock’s Bitcoin ETF boasts a hefty 238,500 Bitcoin (BTC) on its balance sheet, valued at $15.5 billion. The ETF has been witnessing a steady daily inflow averaging around $274 million, equivalent to approximately 4,120 BTC entering the fund each day.

Grayscale’s Current Standing

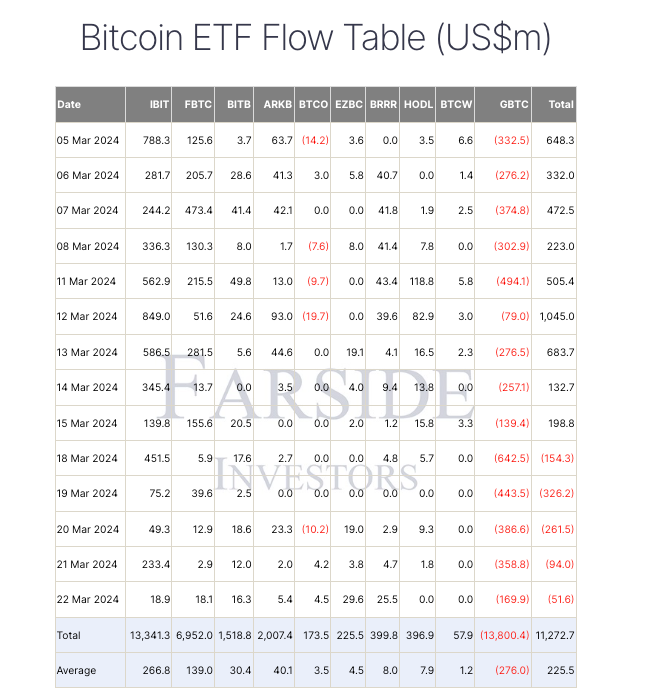

In comparison, Grayscale’s Bitcoin Trust (GBTC) still holds an estimated 350,252 BTC, valued at $23 billion at current market prices. However, GBTC has been experiencing daily outflows averaging about $277 million or roughly 4,140 BTC over the last fortnight.

Impending Flip: BlackRock to Surpass Grayscale Bitcoin Holdings

Assuming no significant alterations in the current flow rates, BlackRock could potentially overtake Grayscale in terms of total Bitcoin holdings by April 11. This scenario might accelerate if BlackRock’s inflows revert to the prior week’s average of 7,200 Bitcoin per day, potentially leading to a flip within 10 days.

Analysts Weigh In

According to analysts, BlackRock’s impending dominance in Bitcoin holdings could mark a significant shift in the institutional landscape. George Tung, a prominent figure in the crypto space, predicts this transition to occur within the next two weeks.

Potential Market Implications

The recent surge in GBTC outflows, reaching a staggering $643 million on March 18, has raised concerns about potential downward pressure on Bitcoin prices. However, analysts like Eric Balchunas suggest that these outflows could diminish substantially within the next few weeks.

BlackRock’s Rapid Accumulation

BlackRock’s spot Bitcoin ETF has swiftly surpassed MicroStrategy’s holdings, now standing at over 238,500 Bitcoin valued at $15.44 billion. The company’s consistent accumulation indicates a bullish stance on Bitcoin’s long-term prospects.

Retail Investor Considerations

Tung advises retail investors to take note of BlackRock’s aggressive accumulation and consider increasing their allocations to Bitcoin. He emphasizes the importance of individual participation in the market amidst growing institutional interest.

Market Dynamics and Outlook

The influx of newly listed spot Bitcoin ETFs has led to negative flows for some, while BlackRock’s ETF continues to attract substantial net inflows. The contrast between BlackRock’s buying momentum and Grayscale’s selling pressure underscores the evolving dynamics within the crypto market.

Encouraging Institutional Participation

Tung underscores the significance of broader institutional involvement in Bitcoin, urging retail investors to actively engage in the market to prevent centralized accumulation by large financial entities.

Conclusion: Navigating Bitcoin’s Institutional Landscape

As BlackRock’s Bitcoin ETF edges closer to surpassing Grayscale’s holdings, the institutional dynamics within the crypto market are undergoing a significant transformation. Retail investors are advised to stay vigilant and proactive in navigating these evolving dynamics, ensuring a balanced and inclusive participation in the burgeoning digital asset landscape.