DeFi Ecosystem Gains Momentum with $10 Billion Daily Volume

Decentralized Finance (DeFi) has emerged as a powerhouse within the financial landscape, showcasing exponential growth in recent years in terms of Total Value Locked (TVL) and exchanged volume. The DeFi space has witnessed a staggering surge, with daily volumes consistently exceeding $10 billion, reminiscent of the bullish trends observed in 2021. In this article, we delve into the remarkable momentum driving DeFi’s ascent and explore the implications for investors and traders alike.

Understanding Volume Trends in DeFi

The volume serves as a pivotal metric for gauging market trends and investor sentiment within the cryptocurrency realm. It provides invaluable insights into various assets and sectors’ liquidity and trading activity. While spikes in volume can signal short-term fluctuations, it is the sustained patterns that truly delineate market momentum and trajectory.

Analyzing DeFi’s Current Momentum

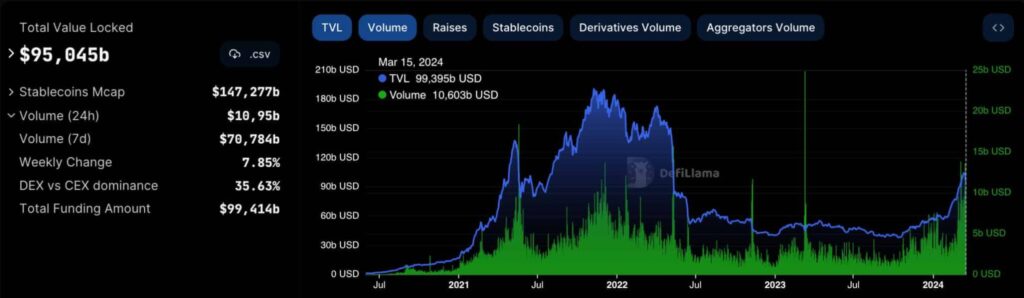

Recent data retrieved from DefiLlama on March 17 underscores a robust momentum within decentralized exchanges, indicating a notable uptick in capital flow across DeFi protocols. With daily exchange volumes surpassing the $10 billion milestone and 7-day volumes reaching $70.784 billion, the DeFi ecosystem is poised for a significant rally. This surge mirrors the growth observed during the early phases of 2021 and the pinnacle of the previous market cycle in November-December 2021, albeit with even greater consistency.

The Shift Towards Decentralized Exchanges

One noteworthy trend is the increasing dominance of decentralized exchanges over their centralized counterparts. DefiLlama data reveals a 35% dominance of decentralized exchanges, highlighting a substantial portion of cryptocurrency traders opting for decentralized platforms. This shift underscores the growing confidence in DeFi protocols and signals a broader transition towards decentralized trading avenues.

Total Value Locked: A Key Indicator

Amidst the escalating volume, DeFi’s Total Value Locked hovers around the $100 billion mark, reflecting investors’ substantial commitments to liquidity mining, staking, and lending activities. Notably, the 24-hour volume represents over 10% of the $95 billion TVL recorded on March 17. While the current TVL is half of the peak reached in 2021, the accompanying volume suggests a potential trajectory towards surpassing previous highs.

Navigating Risks in DeFi Investments

Despite the promising prospects, it’s essential to acknowledge the inherent risks associated with DeFi investments and decentralized trading. Engaging in DeFi protocols requires a comprehensive understanding of their mechanics and associated security concerns to mitigate potential losses effectively. As the DeFi landscape evolves, investors must exercise caution and diligence in navigating this dynamic ecosystem.

Conclusion: Seizing Opportunities in the DeFi Boom

In conclusion, the burgeoning momentum witnessed in the DeFi ecosystem underscores its growing significance within the broader financial landscape. With daily volumes eclipsing $10 billion and Total Value Locked nearing the $100 billion mark, DeFi presents lucrative opportunities for investors and traders alike. However, it’s imperative to approach DeFi investments prudently, acknowledging the inherent risks and complexities associated with this burgeoning sector. By staying informed and exercising due diligence, investors can harness the potential of DeFi while safeguarding their assets in an ever-evolving financial landscape.