Bitcoin Surges to All-Time Highs with Bitcoin Miner Revenue Reaching Record Levels

In recent developments within the cryptocurrency market, Bitcoin (BTC) has once again captured the spotlight by surging to all-time highs (ATHs). This price surge has attracted the attention of investors and enthusiasts and resulted in a significant increase in daily Bitcoin Miner Revenue.

Understanding Bitcoin Miner Revenue and Fees

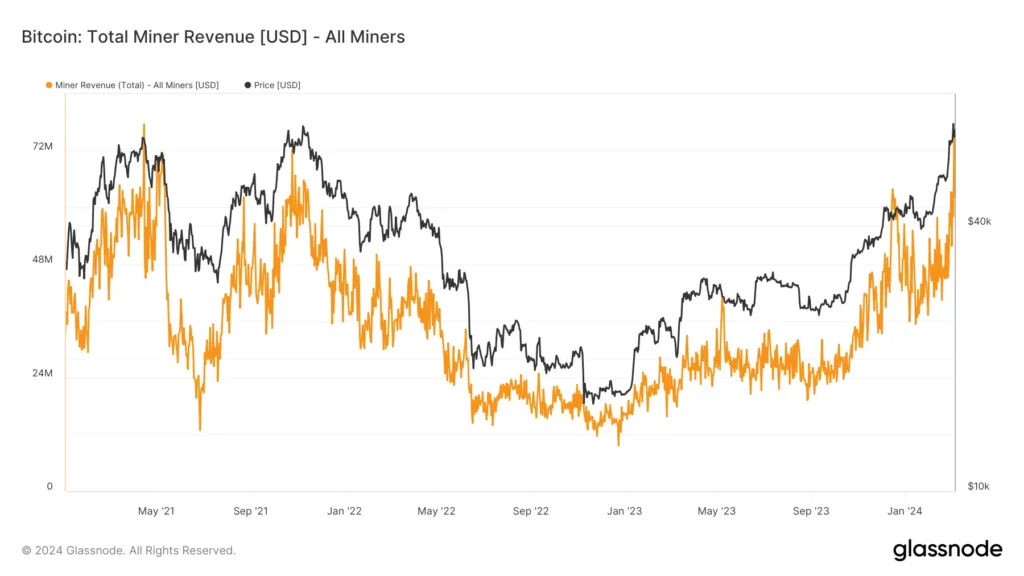

Bitcoin miner revenue has experienced a remarkable spike, particularly notable on the 5th of March. According to data from Glassnode, the daily miner fee soared to an impressive $75.9 million, marking the highest daily revenue since around April 2021.

However, it’s important to note that the daily miner fee has since decreased to approximately $62 million. Despite this decline, the fee remains among the highest observed since December 2021.

Factors Driving Miner Revenue

The surge in miner fees can be attributed to the exponential increase in daily transactions. Santiment’s volume chart indicates that on the 6th of February, BTC volume reached over $102 billion, a level not seen in over a year. As of the latest data, the volume stands at over $55 billion, reflecting sustained market activity.

Impact on Miner Reserve and Bitcoin Price

Analysis of the miner reserve on CryptoQuant reveals a gradual decline as miner fees continue to rise. At present, the reserve stands at over 1.820 million, showcasing a downward trend compared to previous months.

This decline suggests miners actively sell off their holdings as Bitcoin prices climb. While this has yet to significantly impact the price of BTC, continued sell-offs could potentially lead to a price correction shortly.

Bitcoin Price Performance and Market Sentiment

Bitcoin’s price trend on a daily timeframe indicates a pullback after surpassing $68,000 on the 4th of March, marking a significant milestone in its price history. As of the latest update, Bitcoin is trading at around $66,700, following a modest increase in value.

Despite the pullback, Bitcoin remains in the overbought zone, as indicated by its Relative Strength Index (RSI) nearing 75. This suggests a high level of market interest and bullish sentiment surrounding the cryptocurrency.

Investor Interest and Options Market Activity

Recent market activity has seen a resurgence of investor interest, particularly in Bitcoin options that speculate on future price movements. Notably, the $200,000 strike call option on Deribit has garnered significant attention, with a notional open interest of over $20 million.

This renewed interest in deep out-of-the-money (OTM) call options reflects market optimism regarding Bitcoin’s potential to surpass current price levels. The options market, especially on Deribit, has witnessed a surge in total open interest, highlighting growing investor confidence in the cryptocurrency market.

Conclusion

In conclusion, Bitcoin’s recent surge to all-time highs has propelled investor interest and resulted in record-high miner revenue. Despite fluctuations in miner fees and reserves, market sentiment remains bullish, supported by increasing options market activity and sustained trading volume.

As Bitcoin continues to attract attention from both retail and institutional investors, its price trajectory and market dynamics are likely to remain key focal points in the cryptocurrency landscape.