Impact of Bitcoin Halving on Mining: Revenue Decline, Hash Rate Drop, and Strategic Responses

Once a highly lucrative endeavor, Bitcoin mining is now facing significant challenges. The recent halving event has exacerbated these difficulties, leading to a substantial decline in mining profitability. As miners grapple with reduced revenues and increased operational costs, the future of Bitcoin mining hangs in the balance. This article delves deep into the current state of Bitcoin mining, examining the economic pressures miners face, the implications of recent trends, and potential solutions for a more sustainable future.

The Halving Effect and Its Aftermath

Bitcoin’s halving events occur approximately every four years and are designed to reduce the block reward by half. This mechanism aims to control inflation and ensure the scarcity of Bitcoin. The most recent halving, which took place on April 20, 2024, saw the block reward drop from 6.25 BTC to 3.125 BTC. While this event is anticipated and often priced into the market, its immediate effects on miners can be severe.

Post-Halving Difficulty Adjustments

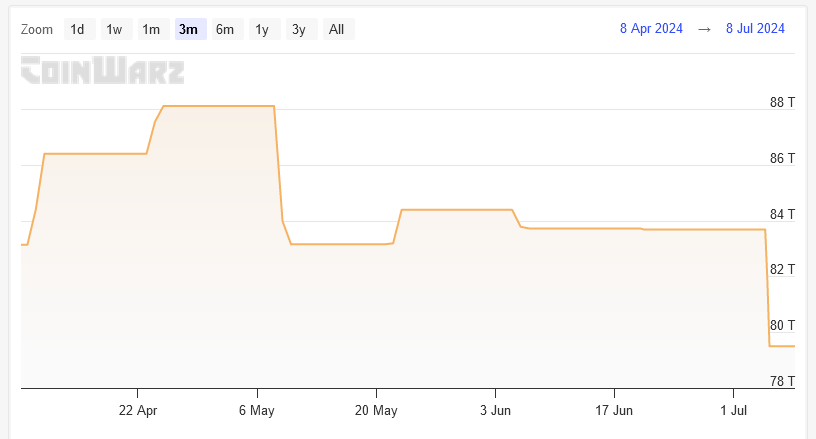

The halving event triggered a significant adjustment in mining difficulty. Mining difficulty, which adjusts every 2,016 blocks (roughly every two weeks), measures how hard it is to find a new block compared to the easiest it can ever be. This difficulty ensures that blocks are found roughly every 10 minutes, regardless of the total hashing power of the network.

According to CoinWarz, mining difficulty decreased by 5% on July 5, 2024, falling from 83.68 T to 79.5 T. This marked the second major decline since the halving event. The first substantial drop post-halving occurred on May 10, 2024, when difficulty decreased by 5.6% from 88.1 T to 83.15 T. These adjustments indicate that many miners are shutting down their rigs as they struggle to stay profitable.

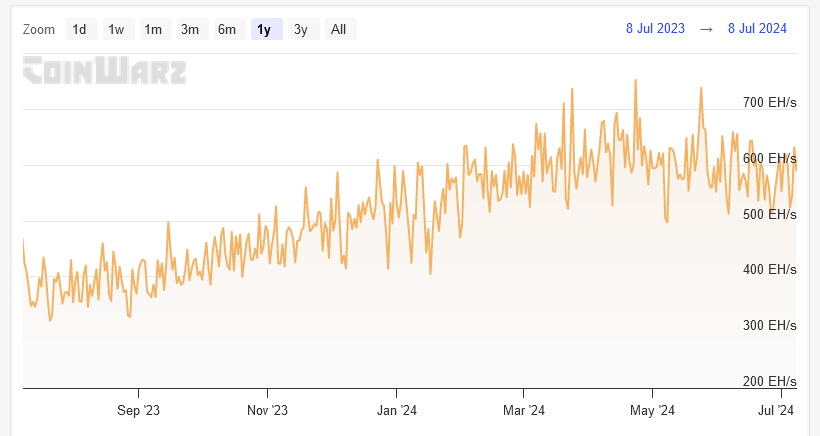

Hash Rate Decline

The drop in mining difficulty parallels a decline in the hash rate, the network’s total computational power. After peaking at a record 751.63 EH/s on April 23, 2024, the hash rate has been steadily falling and now sits at 607.8 EH/s. This decline signifies that fewer miners are contributing to the network, likely due to the reduced profitability post-halving.

Revenue Struggles

Daily revenue figures for Bitcoin miners tell a similar story of struggle. On the day of the halving, miners’ daily revenue peaked at an all-time high of $107.8 million. However, this figure has since plummeted, hitting a local bottom of $22.3 million on July 5, 2024. This sharp decline in revenue highlights the economic pressure on miners and raises concerns about the long-term sustainability of Bitcoin mining.

The HODL Tax Proposal

In response to the growing challenges faced by miners, a controversial solution has been proposed: the HODL tax. This tax aims to boost mining revenue by encouraging more network activity. Under the proposal, addresses inactive for over a year would incur automatic BTC deductions, which would then be redistributed to miners. The deduction would be set at 50% of the median transaction fee from the previous two weeks.

Community Backlash

Despite its intent, the HODL tax has faced significant backlash from the Bitcoin community. Critics argue that it disrupts the fundamental incentive to buy Bitcoin, which currently offers zero carrying costs. This tax could undermine the principle of holding Bitcoin long-term as a store of value, potentially leading to decreased investor confidence and market stability.

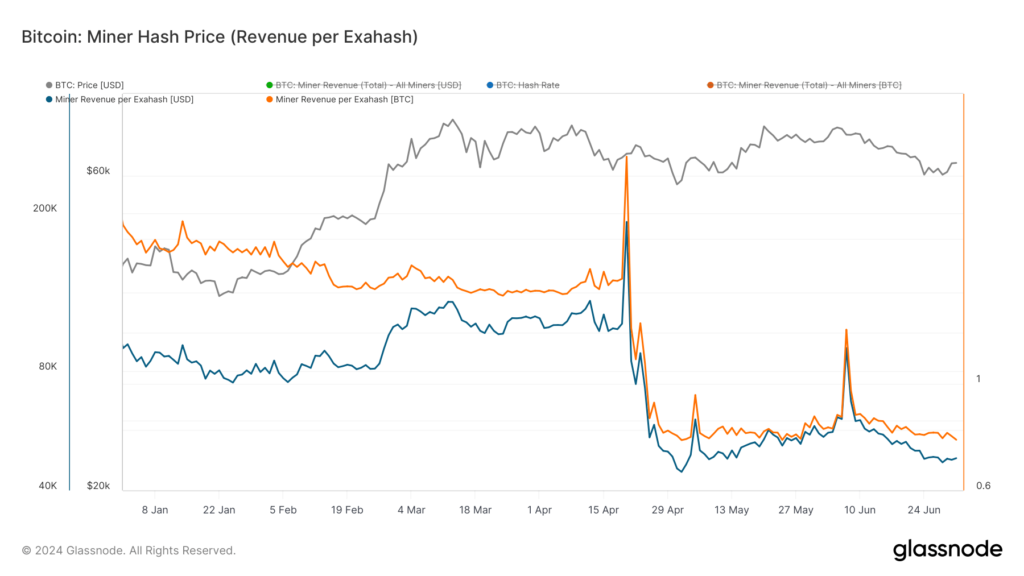

Miner Revenue Per Exahash

Miner revenue per exahash measures miners’ daily income relative to their contribution to the network’s hash rate. This metric is important because it reflects the profitability and economic viability of Bitcoin mining, directly influencing decisions on resource allocation, investment, and operational strategies.

Revenue Decline Post-Halving

Since Bitcoin’s fourth halving, miner revenue per exahash has declined steeply. Initially, on April 20, 2024, the miner revenue per exahash was $190,620 or 2.96 BTC. However, by May 2, 2024, it had plummeted to an all-time low of $44,538 or 0.76 BTC. This decline was anticipated, but its impact has been profound, causing significant economic pressure on miners.

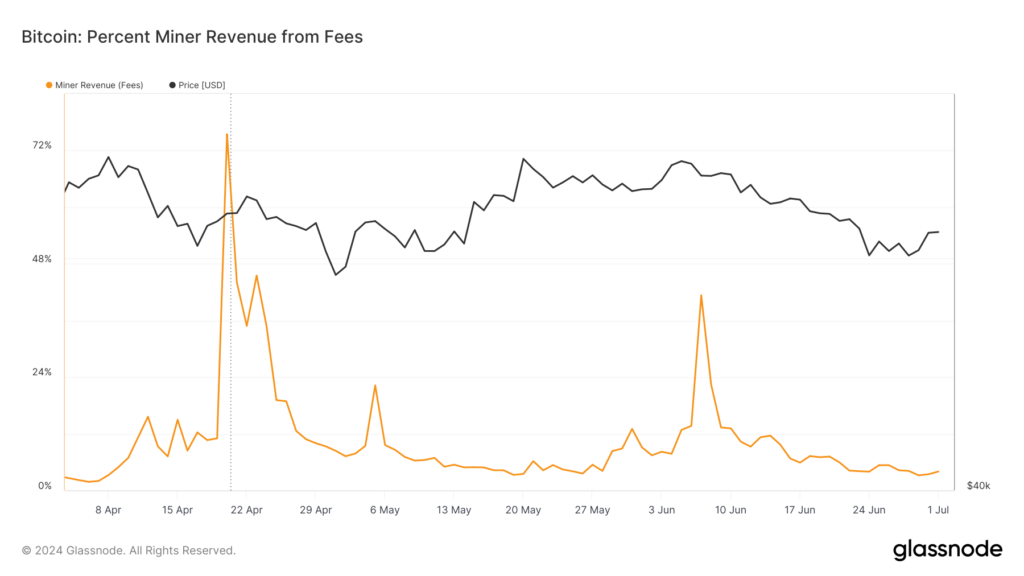

Temporary Revenue Recovery

Glassnode’s data showed a brief revenue recovery peaking on June 7, 2024, with $91,774 or 1.29 BTC per exahash. This temporary increase was driven by a significant surge in transaction fees due to network congestion, with fees comprising 41.335% of miner revenue on that day. This peak highlights the importance of transaction fees as a supplementary income stream for miners, especially as block rewards diminish.

Stabilization and Ongoing Challenges

As of July 1, 2024, miner revenue per exahash stands at $48,230 or 0.76 BTC, indicating a lower stabilization level than pre-halving figures. This prolonged period of reduced revenue poses challenges for miners, particularly those with higher operational costs or less efficient hardware. Comparing miner revenue against the yearly average shows a significant trend of reduced profitability, which could lead to broader implications for the mining industry and the Bitcoin network.

Strategic Responses to Economic Pressures

In response to these economic pressures, Bitcoin miners have been undertaking various strategies to mitigate the impact of reduced revenues.

Consolidation and Expansion

CleanSpark’s acquisition of GRIID Infrastructure for $155 million and Bitdeer’s announcement of a 570 MW expansion in Ohio demonstrate a strategic approach to increasing operational capacity. By consolidating resources and expanding operations, these companies aim to enhance overall output and mitigate the effects of lower revenue per unit of hash power.

Diversification

Marathon’s diversification into mining altcoins like Kaspa is another example of miners seeking alternative revenue streams. By not solely relying on Bitcoin, Marathon Digital is hedging against Bitcoin-specific market risks and broadening its revenue base. Core Scientific’s $3.5 billion deal with CoreWeave to diversify into AI-related activities showcases another shift in strategy.

Investor Confidence

Despite the challenges, confidence in the mining sector remains high. US-listed Bitcoin miners saw a massive surge in stock price over the past week, reaching a record market capitalization of $22.8 billion. This indicates that investors are optimistic about the long-term prospects of Bitcoin mining companies, likely due to their strategic adaptations and the potential for future revenue growth as network congestion and transaction fees fluctuate.

Miner Capitulation and Market Implications

According to market intelligence firm CryptoQuant, Bitcoin miner capitulation metrics are approaching the same level as the market bottom following the FTX crash in late 2022. Miner capitulation is a process in which some miners reduce their operations or sell a portion of their mined Bitcoin and reserves to stay afloat.

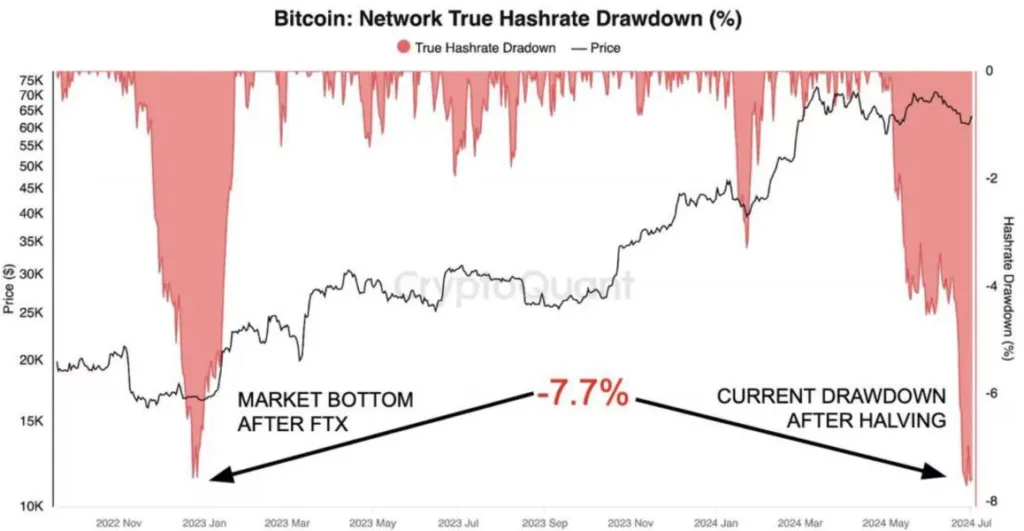

Hash Rate Decline and Capitulation

One of the signs of capitulation is a significant decline in Bitcoin’s hash rate. The total computational power that secures the Bitcoin network has experienced a 7.7% decline, hitting a four-month low of 576 EH/s after peaking at a record-high hash rate on April 27, 2024. This drawdown mirrors an equivalent decline in late 2022 when Bitcoin’s price bottomed at $15,500 before surging more than 300% over the next 15 months.

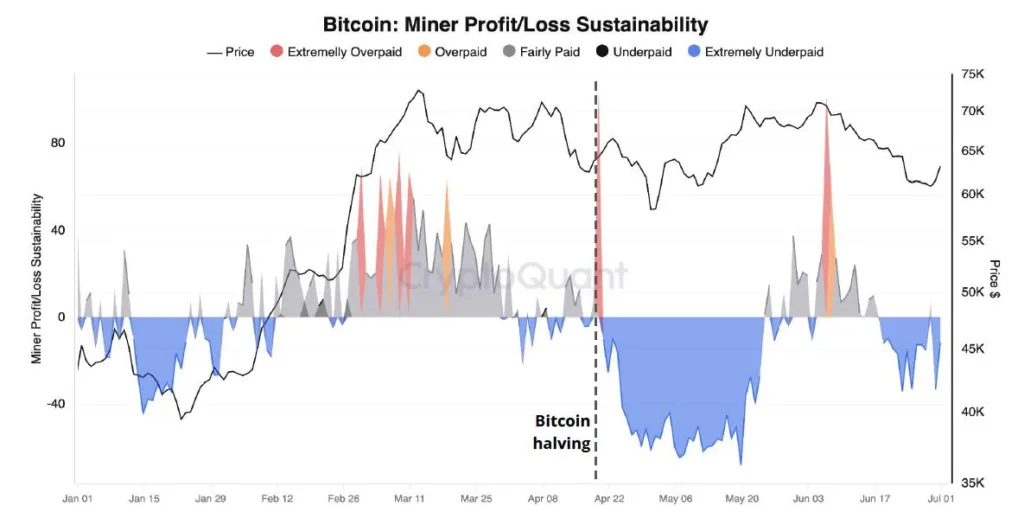

Reduced Miner Revenues

For most of the period since the halving, miners have been “extremely underpaid,” as evidenced by the miner profit/loss sustainability indicator. Total daily revenues have decreased from $79 million on March 6, 2024, to $29 million currently. Moreover, the revenue from transaction fees has fallen to only 3.2% of the total daily revenues, the lowest share since April 8, 2024. Due to decreased revenues, Bitcoin miners have been forced to use their reserves to earn yield, with daily miner outflows spiking to the highest volume since May 21, 2024.

The Path Forward

Adapting to New Realities

The marginal drop in Bitcoin mining difficulty shows that several miners find it challenging to remain operational. This difficulty adjustment could help rebalance the network, allowing remaining miners to benefit from slightly reduced competition and potentially higher revenues if the Bitcoin price or transaction fees increase.

Strategic Adaptations

To navigate the current landscape, Bitcoin miners are adopting various strategies. CleanSpark’s acquisition of GRIID Infrastructure and Bitdeer’s expansion in Ohio demonstrate a focus on consolidation and scaling operations. Marathon’s diversification into mining altcoins and Core Scientific’s deal to venture into AI-related activities highlight the need for alternative revenue streams and strategic flexibility.

Market Confidence

Investor confidence in the mining sector remains strong, as evidenced by the surge in stock prices and market capitalization of US-listed Bitcoin miners. This optimism is likely driven by strategic adaptations and the potential for future revenue growth.

Long-Term Sustainability

To ensure the long-term sustainability of Bitcoin mining, it is crucial to continually adapt to changing economic conditions and technological advancements. Periodic review and updating of mining strategies, exploring new revenue streams, and maintaining operational efficiency will be key to thriving in the evolving Bitcoin mining landscape.

Conclusion

Bitcoin mining is at a critical juncture, facing significant challenges post-halving. The decline in mining difficulty and hash rate, coupled with reduced revenues, highlights the economic pressures miners are under. However, strategic adaptations and investor confidence suggest a path forward. By consolidating operations, diversifying revenue streams, and continually adapting to new realities, Bitcoin miners can navigate the current landscape and ensure long-term sustainability. The future of Bitcoin mining depends on resilience, innovation, and the ability to thrive in an ever-changing environment.